Create Abundance

Introducing Goals Based Investing

Your goals and needs drive how we’ll invest your money. You want assurance that money is available when needed, but is also growing to meet those needs. Your financial plan will help drive the process.

We’ll build your financial plan so that your investments help achieve your goals, and we employ the best available technology to make planning a partnership. Our job is to make investing understandable and accessible.

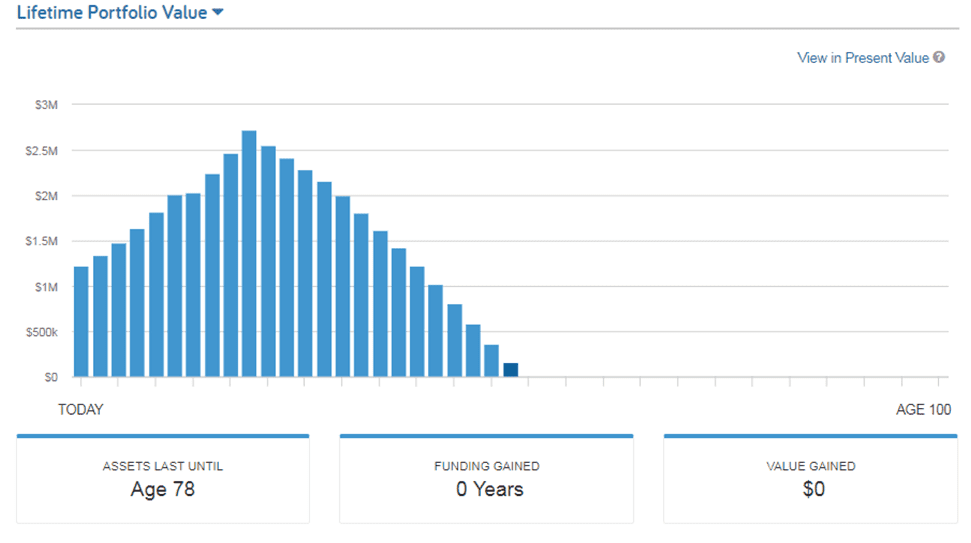

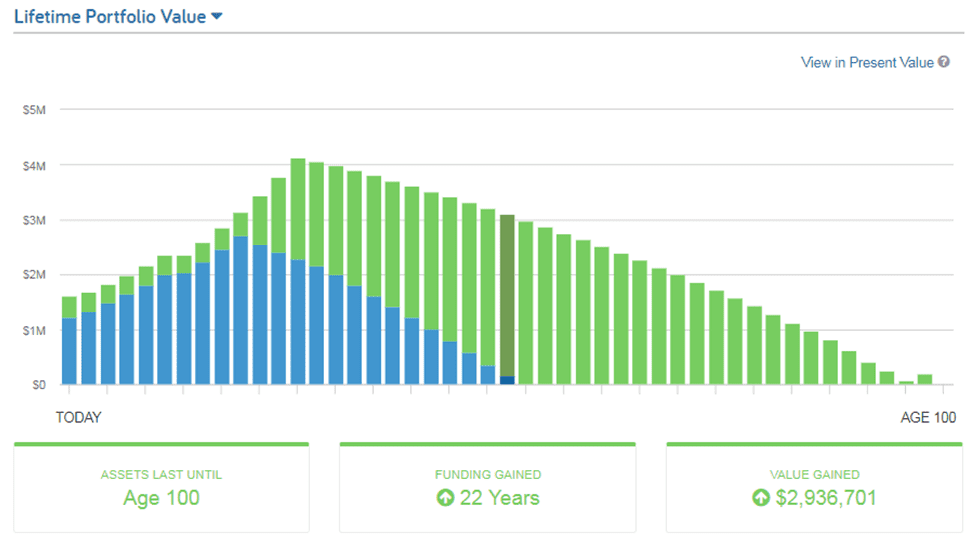

Understanding the Impact of Your Decisions

Life is full of decisions, many of which impact your finances. We can show you what your life will look like based on one decision over another. Whether you’re deciding to downsize or invest in a new business, we can quickly and easily model the financial impact of those decisions for years to come.

Before and After

Understanding Risk and Return

We want to understand the amount of risk you are willing to take, and how much risk you’ll need to take to meet your goals. Risk and return are directly connected – the more risk you are willing to take the higher your average annual return over time. Once we’ve put together a baseline plan, we’ll need to decide how to invest your money and how those decision impact your future.

How much risk are you willing to take?

We use a tool called Riskalyze to show you how much risk you’ll need to take to achieve a return. It’s easy enough to say you’d like to achieve a given annual return, it’s more difficult to agree to relax through market volatility. That’s why we’ll show you what it feels like on a good day and a bad day, before a dollar is invested.

When do you need the money?

Money that you need right away needs to be treated differently than money that won’t be needed for a while. We’ll take a closer look at when you’ll actually need the money. We’ll glance at your 5-year cash flow to see how much money you’ll depend on in the near term, and then take look down the road to see what your needs are. This timing will play into how each of your accounts is invested differently.

Diversification

Diversification helps investors weather both good and bad markets. By participating across the markets you are never the big winner nor the big loser. It helps reduce risks and helps smooth out wild swings. Because staying invested is the time tested way to win in the end.

Setting a Framework

First, we’ll set a strategic allocation. This is the portion of stocks and bonds that you feel comfortable holding. We’ll show you what it feels like – on both a good and bad day.

Building Your Portfolio

Next, we’ll decide on what types of investments you prefer and help you understand the benefits and trade-offs of each.

Rest assured, we serve as your fiduciary, which means we act in your best interests. You’ll walk away with a financial plan and we’ll implement a custom portfolio tailored to your needs. So give us a call and let’s get started today!